Risk! Logo 1959: https://www.firstversions.com/2017/01/risk.html

Remember “Risk!”?

This boardgame took hours and hours of my youth to play and, without fail, it was impossible to hold Asia and Central Europe. Someone always attacked my flank and drove me back to Australia.

What was the gateway country on the ‘Risk!’ board between Asia and Europe? Ukraine. Three months ago, a fair percentage of Americans probably didn’t know where Ukraine was, now a most human tragedy is unfolding on our iPhones in real time.

It has been difficult to watch personally; my ancestors come from an area called Galicia, an ancient state in what is now Poland and Ukraine, whose capital was Lviv. Thankfully my Grandparents are no longer with us so they don’t see what is happening now. But conflict has been a relative constant in the history of Ukraine; this area has been fought over for centuries, enduring invasions by Tatars and Mongols and suffering broadly in the World Wars. And interestingly, Russia is about to make the same mistake that triggered the end of Imperial Russia.

Since I’m a “money guy” the question I’d like to address here is, how does this affect you and your money? I tell clients that Risk is a combination of Danger and Opportunity*, are there dangers to you and your financial well-being from a conflict unfolding an ocean plus a continent away?

The short answer: There is no right answer, and that is the Danger.

We are at a point in time where the ‘Peace Dividend’ that came at the end of the Cold War has been spent. Geopolitics is again becoming a factor in investment decisions after 4 decades of relative dormancy and will be an increasingly important element as countries and peoples compete for the resources and riches of the 21st century.

First, what is geopolitics? This subject fills books, let’s just say geopolitics is “the struggle over control of geographical entities with an international or global dimension…for political advantage”. **

I’d suggest the following framework for adding a geopolitical variable into your investment decisions:

- History: What is the geopolitical history of competing sides in a conflict?

- Economy: What are the economic ramifications of winning/ losing for either side?

- Political: What alliances aid or impede either side to complete its mandate?

- Military: Which side can force its will upon the other?

- Scenarios: Can you develop potential narratives regarding the above variables that help to plan for potential market shocks or market surprises?

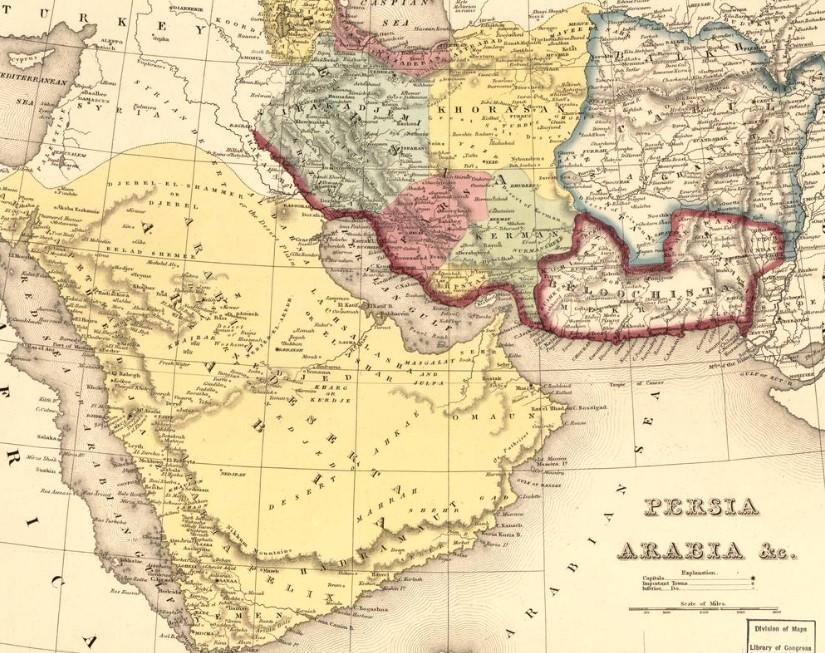

There are many scenarios to examine and that is where we can gain some guidance and quantify some level of Risk. We’ll start from almost two centuries ago with the Crimean War (1853) and work our way to your wallet.

History: The graphic of the Crimean war below is from Hidden Levers, a portfolio risk management platform I use with my clients. It very accurately points out how history, while not exactly repeating, is certainly rhyming in Crimea and Ukraine.

Prior to the Crimean War, the Imperial Russian Empire included all current day Ukraine and Belarus. As a result of this brutal, bloody conflict Russia effectively lost naval control of the Black Sea, lost the Delta of the Danube, and lost 500,000 troops.

Economy: Within two years after the Crimean War Imperial Russia suffered an economic crisis which led to widespread bank failures. This was the beginning of the end of Imperial Russia, fifty years later the first Russian Revolution sowed the seeds for Lenin and the rise of Communism. Is this a script for today? Is ‘Oligarchic Russia’ ending and what does that mean for the world economy?

The media have been trumpeting the effectiveness of sanctions on the Russian economy, their ‘oligarchs’, and on the banking sector, but do the media also have any narratives on how the global economy will simply sail smoothly past the potential sovereign default of a country that is currently about 2% of Global GDP?

Here is the danger; debt defaults destroy collateral and can have a daisy-chain effect, causing imbalances and crises in places one may not expect. While developed market banking systems should handle any Russian sovereign default without major issues, we truly don’t know who is holding all the ‘bad cards’ of Russian debts, sovereign or corporate. Other emerging markets could suffer through ‘guilt by association’. In other words, if a butterfly flaps its wings (with a Russian bank failure) can it cause a global hurricane? This form of economic warfare could have massive unintended consequences going forward. Please refer to an earlier note I wrote (https://haddamroad.com/insights/invest-history-rhymes) about Lehman Brothers failure in 2008.

Political: The Ukrainian President has done a masterful job of aligning with Western powers. So much so that NATO is now poised to potentially border Russia directly if Finland joins. Russia has, through its own actions, brought new threats to its Western border. Russia now needs to be super-friendly and accommodating to its Eastern neighbors, specifically China. How realistic is a new Cold War? Is NATO (US / Europe) vs Russia / China a real possibility? That split would be a real bummer for global trade.

Military: The fog has not yet lifted from this current war but it is worth emphasizing that the current Russian president is well versed in the history of Russia’s Crimean embarrassment and is certainly motivated to reverse it, the truly unknown risk is how far will he go to succeed?

As Russia scales up this aggression

- What is NATO’s reaction and does the US turn this into a proxy war?

- How does China react to any escalation by NATO / the US?

How do three major nuclear powers (Russia, US, China) play out this high-stakes, real-world game of ‘Risk!’?

But the question here for you and your money is, how can we factor geopolitical risk into your investment decisions and to your overall economic well-being?

Financial Scenarios: There is no right answer, but there are many scenarios worth examining. Scenario analysis helps us better define the Dangers and Opportunities in markets going forward.

Firstly, I’d posit the risks of a major market crisis, while small, are higher than any time since the end of the Cold War because the ocean of Central Bank liquidity provided since the pandemic is just starting to drain away. That is a subject for a later post.

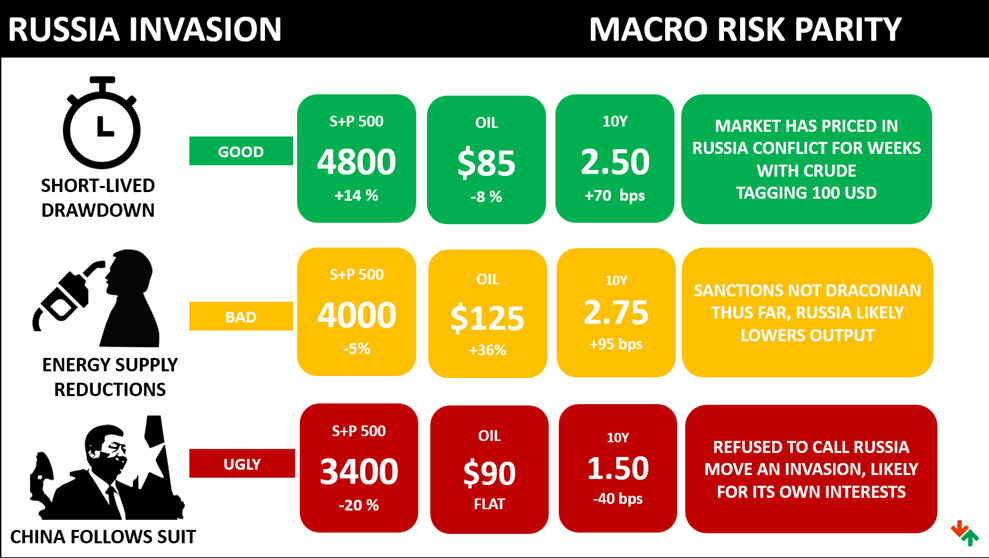

Taking into account the variable we outlined above there are endless combinations of events that can affect markets going forward so we’ll limit ourselves to three, a Good, a Bad, and an Ugly (h/t Clint Eastwood).

Hidden Levers, the risk management software mentioned earlier, helps with some “If/Then” analysis:

If:

- Good: sanctions take hold, there is a cessation of violence, Russia relents.

- Bad: Russia survives sanctions, inflicts damage upon Europe’s economy by limiting gas supplies.

- Ugly: China aids Russia, buys crude oil, and advances its interests in its own backyard.

Then:

- Below are Hidden Levers’ market projection of the scenarios above regarding the

- S&P 500

- Crude Oil

- The US 10-year Treasury Bond

- These scenarios can now be used to stress test to each client’s specific holdings and keep them better informed about future risks and what we’re doing to mitigate those risks.

Source: Hidden Levers War Room, Inflation + Energy, Feb 2022

Source: Hidden Levers War Room, Inflation + Energy, Feb 2022

This is a great way for us to distill a lot of moving parts into an overarching plan and keep clients informed about current and future market Dangers and Opportunities.

This type of planning focuses more on dangers and defenses against those dangers, so what are we doing at Haddam Road Advisors to protect against an “Ugly” scenario?

Here’s a few investments worth considering (and where we are allocating client monies currently):

- Buying Volatility: This is difficult to do because, in layman’s terms, volatility leaks and costs money to own. If the recent nuclear rhetoric becomes reality (not probable in a sane world, but possible) this is an effective protection against a Black Swan event.

- Long-dated US Treasuries: In times of conflict global reserves tend to shelter with the strongest military power. US Treasuries have had a torrid year thus far and, in the event of a global escalation of this conflict, could prove a bargain. In the ‘Ugly’ scenario above, long-dated Treasuries price could rally 25% or from current levels, that can be a useful risk mitigator. If the current conflict ends positively this allocation could suffer but it is good insurance in the meantime.

- Real Estate: Keep in mind Adam Smith’s caveat about real estate, it is not the value of the land, brick and mortar involved but the value of the activities that occur on that land and within the bricks and mortar.

- Current ‘valuable activities’ we consider worthy of client dollars:

- Farmland

- Logistics

- Data Centers

- Healthcare providers

- Real Assets: Gold, yes. It has been a hedge for 6000 years and an allocation to this space may not be as sexy as it once was, it has stood the test of time.

- The jury is still out with crypto but is too highly fragmented (and currently highly levered). My clients do have a small allocation and we will add as it matures, but I would not consider it mature enough as a geopolitical hedge.

- Cash. For limited periods of time cash is a viable safe-haven, even if it will suffer in an inflationary environment. It is ‘dry powder’ that can mitigate risk if markets go lower and offers the opportunity to take advantage of bargains that inevitably arise in market dislocations.

I’d suggest talking with your advisor about the risks in the current macro environment and how they might affect your money.

As always, I enjoy working with clients who want to understand their finances and actively involved in shaping their future. Change Happens. Let us be there for you in managing your precious capital through that change.

Brian Kearns, CPA/CFP®

Haddam Road Advisors

Certified Public Accountant

Certified Financial Planner™

Registered Investment Advisor

brian@haddamroad.com

Ph: (312) 636-3067

NOTE: This is being provided for informational purposes only and should not be construed as a recommendation to buy or sell any specific securities. Past performance is no guarantee of future results and all investing involves risk. Index returns shown are not reflective of actual performance nor reflect fees and expenses applicable to investing. One cannot invest directly in an index. The views expressed are those of Haddam Road Advisors and do not necessarily reflect the views of Mutual Advisors, LLC or any of its affiliates.

Investment advisory services offered through Mutual Advisors, LLC DBA Haddam Road Advisors, a SEC registered investment adviser.

* I first heard the description of risk as a combo of Danger and Opportunity from Prof. Aswath Damodaran: https://pages.stern.nyu.edu/~adamodar/

** Colin Flint, Introduction to Geopolitics, 3rd edition. Pg 16

- April 2025 (4)

- March 2025 (2)

- February 2025 (1)

- January 2025 (8)

- December 2024 (1)

- November 2024 (8)

- October 2024 (6)

- September 2024 (1)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- May 2022 (1)

- February 2022 (1)

- September 2020 (1)

- August 2020 (2)

- June 2020 (1)

- February 2020 (1)

- January 2020 (1)

- December 2019 (4)

- November 2019 (2)

- October 2019 (1)

Subscribe by email

You May Also Like

These Related Insights

A Roth IRA Is Not Tax-Free, It Is a Tax Swap

IRAN: What are the risks to your portfolio?