Planning Grid: Mastering Debt and Financial Obligations

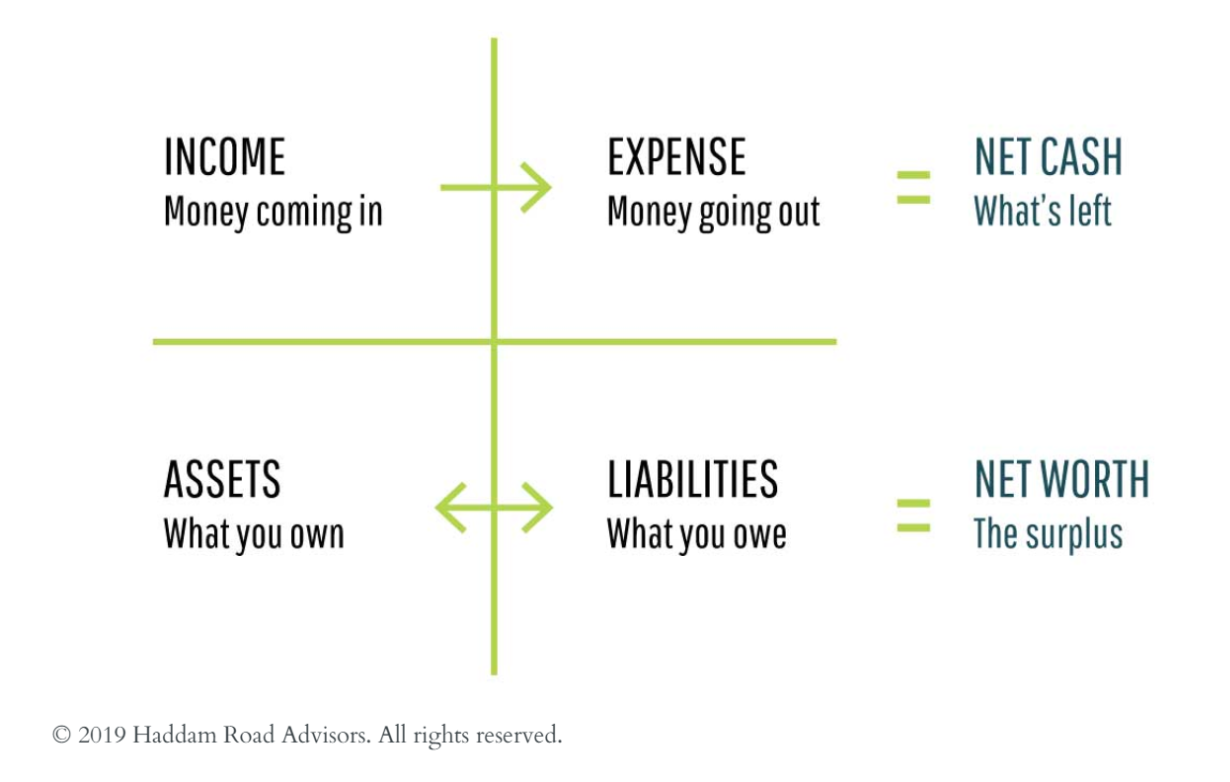

Mastering Debt and Financial Obligations: A Key Step in Financial Planning focuses on understanding and managing your liabilities to achieve financial stability. By evaluating your debts, prioritizing repayment strategies, and balancing obligations with other goals, you can take control of your financial future.

At Haddam Road Advisors, we guide clients through strategies to reduce debt and optimize their financial obligations. This blog explores actionable steps to help you master your liabilities and build a stronger financial foundation.

Final Thoughts

Debt management is a critical piece of a well-structured financial plan. The goal is to ensure that you’re using debt to build a stronger financial future, not weighing it down. Combined with managing inflows, outflows, and assets, controlling debt ensures you have a comprehensive approach to your finances.

At Haddam Road Advisors, our Financial Planning Standard of Care outlines 70 different financial issues that may arise in your planning process. We encourage you to download our white paper to learn more and dive deeper into how you can optimize your financial plan.

- April 2025 (4)

- March 2025 (2)

- February 2025 (1)

- January 2025 (8)

- December 2024 (1)

- November 2024 (8)

- October 2024 (6)

- September 2024 (1)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- May 2022 (1)

- February 2022 (1)

- September 2020 (1)

- August 2020 (2)

- June 2020 (1)

- February 2020 (1)

- January 2020 (1)

- December 2019 (4)

- November 2019 (2)

- October 2019 (1)

Subscribe by email

You May Also Like

These Related Insights

Planning Grid: Mastering Debt and Financial Obligations

Planning Basics: The 5 things you can do with your income