Planning Grid: Mastering Debt and Financial Obligations

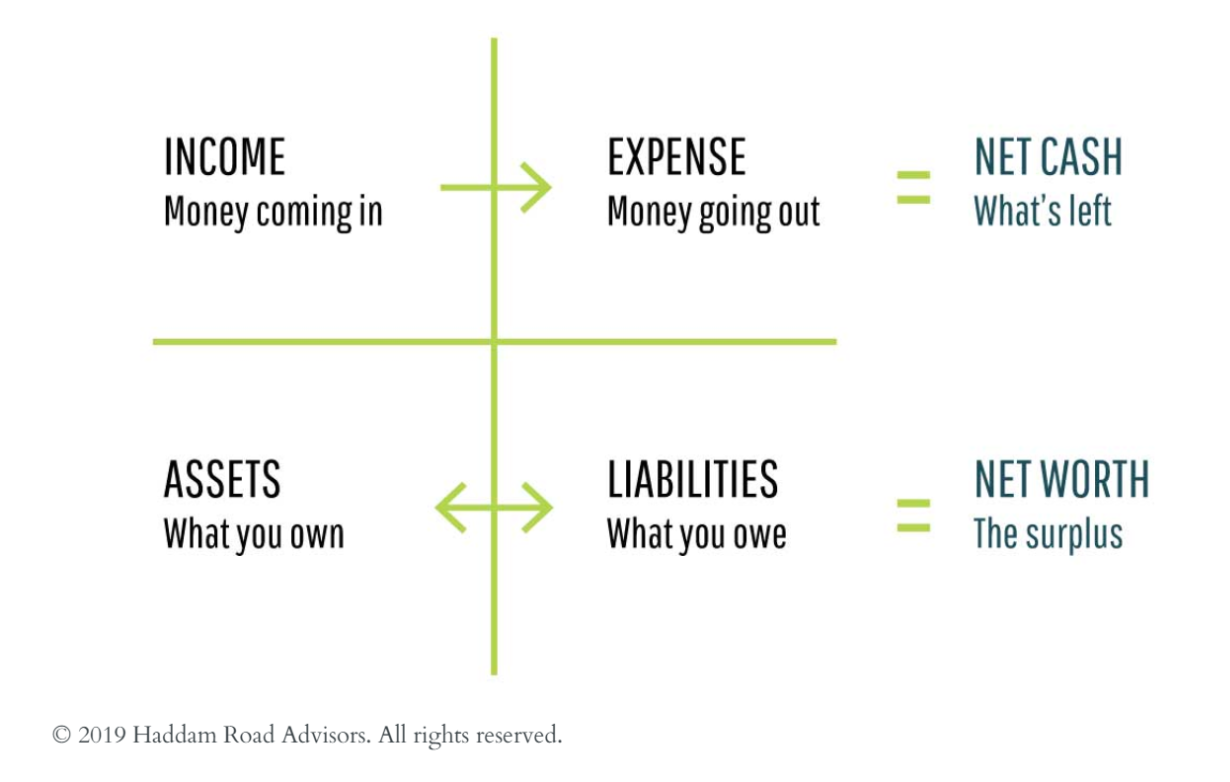

In this final part of the Planning Grid series, we explore what you owe—specifically, the role of debt in financial planning. Debt represents an obligation against your future income, and how you manage it can greatly impact your financial health. There’s a distinction between good debt—used for investments like homes or education—and bad debt, such as high-interest credit card balances used for short-term gratification. Managing your debt is crucial, as the ability to repay relies on future earnings.

Understanding Debt: Good vs. Bad

Debt is not inherently negative, but the key lies in how the funds are utilized. For example:

- Good Debt: If you use a mortgage to buy a home that appreciates in value, or if you take out student loans that lead to a higher-paying job, these are considered good debts. They serve a long-term purpose and eventually contribute to your financial well-being.

- Bad Debt: On the other hand, if debt is used for non-essential purchases, such as a lavish vacation, and you lack the means to pay it back, this becomes bad debt. It doesn’t offer any future financial return and can become a major burden.

Always remember that debt is an obligation against future income. It can be a powerful tool if used correctly, but if mishandled, it can be a significant hurdle.

Key Considerations for Debt Management

Several factors should be considered when managing debt:

- What Underlies the Debt? Is it tied to essential needs like housing or transportation, or is it unsecured debt, like credit card balances?

- When Will the Debt Be Paid Off? Understand the timeline for repayment. Mortgages come with amortization schedules, and credit cards, if paid only with minimum payments, can take years to repay.

- Deferred Taxes: This is another form of obligation tied to your future income, particularly with traditional retirement accounts like IRAs and 401(k)s. These accounts come with embedded tax bills that must be paid when you begin withdrawals, often after age 72.

Final Thoughts

Debt management is a critical piece of a well-structured financial plan. The goal is to ensure that you’re using debt to build a stronger financial future, not weighing it down. Combined with managing inflows, outflows, and assets, controlling debt ensures you have a comprehensive approach to your finances.

At Haddam Road Advisors, our Financial Planning Standard of Care outlines 70 different financial issues that may arise in your planning process. We encourage you to download our white paper to learn more and dive deeper into how you can optimize your financial plan.

- April 2025 (4)

- March 2025 (2)

- February 2025 (1)

- January 2025 (8)

- December 2024 (1)

- November 2024 (8)

- October 2024 (6)

- September 2024 (1)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- May 2022 (1)

- February 2022 (1)

- September 2020 (1)

- August 2020 (2)

- June 2020 (1)

- February 2020 (1)

- January 2020 (1)

- December 2019 (4)

- November 2019 (2)

- October 2019 (1)

Subscribe by email

You May Also Like

These Related Insights

Planning Grid: Mastering Debt and Financial Obligations

Planning Basics: The 5 things you can do with your income