The Why, What, and How of Financial Planning: Standards of Care and the Planning Grid

At Haddam Road Advisors, we approach financial planning with precision and care. Over the course of a few blog posts, I'll be diving deep into the "why," "what," and "how" behind financial planning and portfolio management. These are foundational questions to help you understand the importance of having a solid financial plan and how we implement it using our specialized Planning Grid.

Why Do You Need a Financial Planner and Portfolio Manager?

It’s a good question and one I hear often. Many people believe they can manage their finances on their own, but the reality is that financial planning involves navigating a vast number of issues that arise throughout life. At Haddam Road Advisors, our Standard of Care outlines about 70 different financial issues you may face over the course of your lifetime. This includes everything from tax planning, retirement savings, and estate management, to portfolio diversification and risk assessment.

This extensive list of potential financial challenges isn’t comprehensive, but it gives you an idea of how intricate your financial landscape can become.

What Does a Proper Financial Plan Look Like?

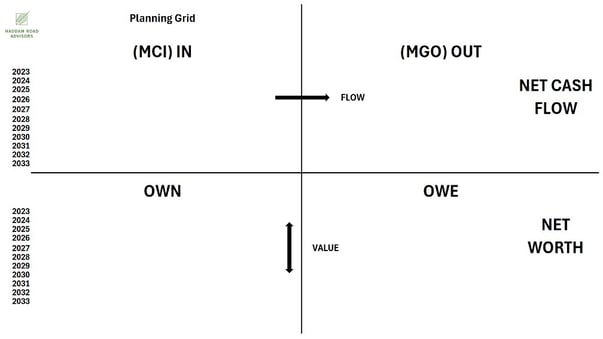

A proper financial plan takes into account both the present and future financial well-being of an individual or family. Net Cash Flow and Net Worth are the two primary metrics we focus on when designing a plan.

This is where our Planning Grid comes into play. It is a straightforward but powerful tool to break down your financial situation and categorize the essential components.

- Money Coming In (MCI):

- This represents all sources of income flowing into your life. Most commonly, it includes salary, interest, and dividends. But other sources, such as gifts or windfalls, can also factor in. We'll explore more of these in future posts.

- This represents all sources of income flowing into your life. Most commonly, it includes salary, interest, and dividends. But other sources, such as gifts or windfalls, can also factor in. We'll explore more of these in future posts.

- Money Going Out (MGO):

- This section tracks the money flowing out of your life—essentially, your expenses. These include both fixed and variable costs, such as taxes, housing, and lifestyle expenses. This is where you determine what it costs to live your life today.

These two factors together create your Net Cash Flow metric. If your inflows exceed your outflows, you have a surplus—this surplus is crucial for saving and investing.

-

What You Own (Assets):

- When you manage your surplus well, it adds to your assets—things you own like savings, investments, real estate, or any other valuable items. The goal is to accumulate enough assets that provide future security.

- When you manage your surplus well, it adds to your assets—things you own like savings, investments, real estate, or any other valuable items. The goal is to accumulate enough assets that provide future security.

-

What You Owe (Liabilities):

- Debt represents the obligations you have against future income, such as mortgages, loans, or credit card debt. Not all debt is bad; some forms of debt, like a mortgage, can actually help you build wealth. We’ll explore more on good vs. bad debt in a future post.

These components together form the core of your Net Worth. While Net Cash Flow is your focus in the present, Net Worth becomes your focus for the future.

How Do We Serve Our Clients?

We begin with the Planning Grid to create a clear, step-by-step approach to addressing your financial concerns. This grid helps us break down complex financial planning issues and incorporate them into a cohesive strategy for you. Every financial decision you make—whether it's increasing income, managing expenses, or dealing with debt—fits into this larger picture.

Our goal is to provide a plan that doesn't just focus on your immediate needs but also sets you up for long-term success. Whether it's figuring out how to save more, determining how much risk to take on in your investments, or planning for retirement, our focus is on guiding you through these decisions in a clear, non-judgmental way.

Haddam Road Advisors Planning Grid

The Planning Grid: A Closer Look

To break it down visually:

- Top Left (MCI – Money Coming In): Where income flows into your life.

- Top Right (MGO – Money Going Out): Where expenses flow out, determining your net cash flow.

- Bottom Left (OWN): Your assets—things you own.

- Bottom Right (OWE): Your liabilities—things you owe.

The goal is to balance these two measures—cash flow and net worth—to create a stable and prosperous financial future. A positive cash flow feeds into your assets, increasing your wealth, while managing liabilities ensures that you are not weighed down by debt in the long term.

Conclusion

At Haddam Road Advisors, financial planning is not about quick fixes or one-size-fits-all solutions. It’s about a comprehensive understanding of your life, your financial flow, and the decisions you make to balance the present and future. With our Planning Grid, we help you focus on what matters now (Net Cash Flow) while preparing you for what lies ahead (Net Worth).

Stay tuned for future posts, where I’ll dive deeper into topics like income types, tax strategies, investment risks, and debt management. These insights will help you make informed, strategic decisions about your financial future.

We look forward to continuing this journey with you! if you would like to learn more about Haddam Road Advisors and how we can help you achieve your financial goals, please schedule a call below.

- April 2025 (4)

- March 2025 (2)

- February 2025 (1)

- January 2025 (8)

- December 2024 (1)

- November 2024 (8)

- October 2024 (6)

- September 2024 (1)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- May 2022 (1)

- February 2022 (1)

- September 2020 (1)

- August 2020 (2)

- June 2020 (1)

- February 2020 (1)

- January 2020 (1)

- December 2019 (4)

- November 2019 (2)

- October 2019 (1)

Subscribe by email

You May Also Like

These Related Insights

The Why, What, and How of Financial Planning: Standards of Care and the Planning Grid

Planning Grid: What You Own and Its Role in Financial Planning